Explore Receivables Financing

Get instant approvals with rates as low as 2.99% for top qualifying clients. Apply today to see what you qualify for with no impact on your personal credit.

BUSINESS FUNDING SOLUTIONS

BUSINESS LINE OF CREDIT

BUSINESS LOANS

WORKING CAPITAL

EQUIPMENT FINANCING

RECEIVABLES FINANCING

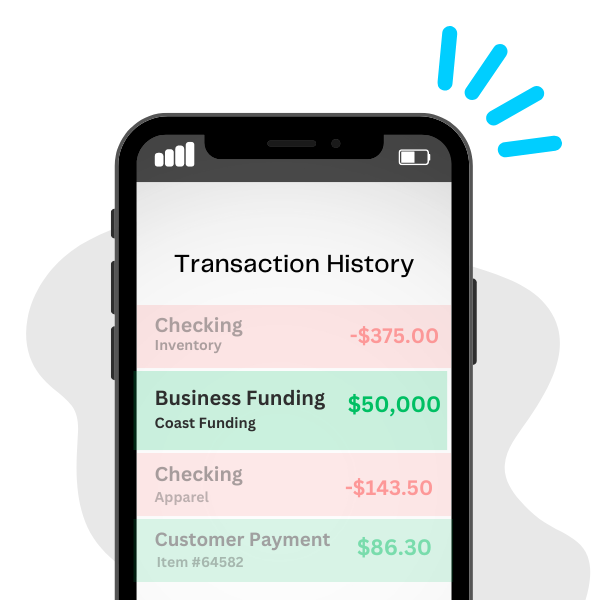

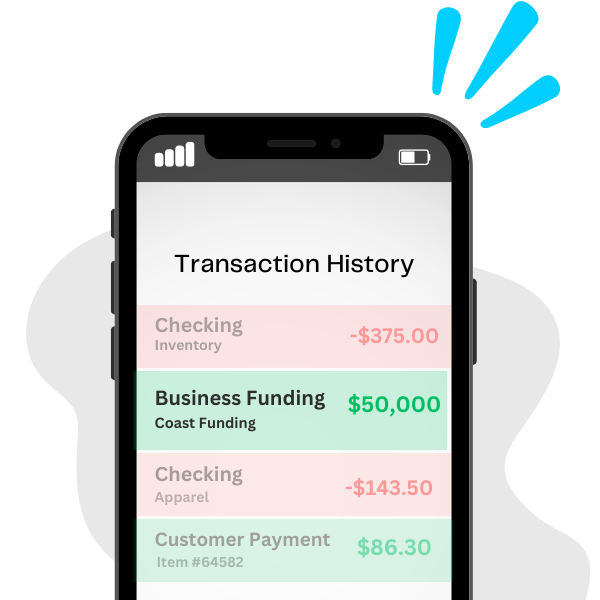

Coast Funding provides working capital solutions and specialty financing to small businesses nationwide. There is no impact to your personal credit to apply for business funding and funds can be available in as little as 24 hours!

- Only take what you need and only pay for what you use.

- Programs from $10,000 - $500,000.

- Flexibility to draw funds whenever you need them.٭

- Monthly rates starting at 2.99%.

- Finance growth with a short-term business loan.

- Programs from $10,000 - $1,000,000.

- Great for funding a specific business investment, like financing a large project or business expansion.

- Access funding based on your business revenue.

- Programs from $5,000 - $2,000,000.

- Great for financing large investments or taking advantage of growth opportunities.

- Purchase equipment for you business.

- Funding from $10,000 - $5,000,000.

- 2 to 5 year terms, fixed monthly payments.

- Specialty programs for medical and construction equipment.

- Turn unpaid invoices or purchase orders into upfront cash today.

- Funding from $10,000 - $1,000,000.

- No restrictions on how the money is used.

- Great for financing growth or increasing capacity for large clients.

Access Up To $5 Million in business funding with premium programs and competitive rates. Utilize our safe and secure application portal and experience same-day business funding.

A line of credit gives your business access to a revolving funding facility that can be used to cover business expenses. The great part is, you only need to take what you need and pay for what you use! Once approved, most clients have access to their funds within one business day with same day funding options available. Most clients use this funding for working capital, inventory purchases, increasing marketing budget or launching new marketing campaigns, covering payroll expenses, purchasing new equipment, and helping bridge gaps in cash flow. A business line of credit is one of the best options on the market for short-term business needs. Interested in finding out more? Speak to one of our funding advisors today!

Short term business loans are a great option for clients that need upfront capital to finance specific business needs or growth opportunities. Most clients use the funds for remodeling their location, starting a large project, expansion, equipment, additional marketing and employees, or various large purchases that can’t be covered with cash reserves or existing credit lines. With the business loan you get access to a lump sum of capital to use how you see fit within your business. Terms typically range between 6-24 months depending on the funding amount and qualifications of the business. If you are interested in learning more, contact one of our experienced funding advisors today!

The working capital program gives your business upfront cash for any business-related needs or expenses. The benefits include fast approval, no restrictions on how the money is used, not tied to personal credit, and is a renewable source of capital. Our working capital program is one of the most flexible programs available and often more cost effective than many of the line of credit programs on the market today.

Let’s face it, your business can’t function without the right equipment. Every business needs high quality, modern equipment as a necessary part of your business, from heavy equipment like forklifts to large medical equipment. With equipment financing, you can access up to $5,000,000 in funding for your business. Our dedicated business advisors will work to get you a quick approval on the equipment you need with favorable repayment terms that are customized to your business profile.

You no longer need to wait 30, 60, or 90 days for your customers to pay. Our programs give you the flexibility to turn your unpaid invoices or purchase orders into upfront cash today. We provide specialized programs for medical, construction, wholesale, apparel, technology, and manufacturing industries.

Join an exclusive circle of elite businesses:

5 Minute

Application Process & Fast Funding

2 Billion

Funded to over 55,000 U.S. Businesses

5 Star Rating

On Trust Pilot

Why Do Thousands of Americans Trust Coast Funding?

Simple Process

Let’s face it, there aren’t enough hours in the day for any business owner. Coast Funding provides the most streamlined business funding application process in the industry.

Relationship Focused

Our team of Business Funding Advisors are standing by to help secure the funding you need to achieve your business goals. We take the time to understand what you are looking to accomplish, then tailor the programs specific to your business needs.

Renewable Resource

We specialize in programs that provide a renewable source of capital. Access the capital you need today and a funding solution you can rely on in the future.

Business Funding FAQ's

Coast provides funding solutions tailored to the unique needs of high-end businesses. Coast specializes in business funding programs for sophisticated business owners and entrepreneurs who want to capitalize on growth opportunities and who need a financing partner they can rely on. Our top programs include business line of credit, working capital line, revenue-based financing, short term business loans, equipment financing and receivables financing.

The first step is to click Apply Now to initiate the online application process. Once your initial information is submitted, check your email for a link to verify you email and finish the online application. We’ll ask you for some basic information about you and your business. Once the application is submitted, you could get a decision in as little as five minutes.

Here are the general guidelines and minimum requirements for approval:

- Business must be generating $8,000 per month in verifiable revenue.

- While personal credit score does not define approval, we see best results with scores 600 and above.

- Must be in business for at least 6 months.

- No prior bankruptcy preferred (business or personal), if prior bankruptcy, must be discharged 12 months prior to application.

- Business must be in good standing with the Secretary of State.

- Business must link bank account using Plaid™ or submit the last 4 months of statements for verification. (Plaid™ connection expedites approval process)

You can apply with Coast if your business meets the minimum qualifications and does not operate in one of the following industries:

- Ineligible industries:

- Illegal gambling

- Pornography

- Political campaigns

- Financial institutions and lenders

- Auto dealerships

- Ineligible industries:

Coast Funding utilizes a soft pull to verify identity and determine qualifications. Applying and seeing what you qualify for will not impact your personal credit score. Certain programs may result in a hard inquiry; however, this will only occur with notice after an approval has been issued and your offer has been accepted. Further, if you default on a Coast Funding program you may be subject to negative business reporting and personal credit reporting where applicable.

With funds as soon as the same business day, competitive rates, and no prepayment penalties, Coast Funding lets you take advantage of growth opportunities. You could use the funds to cover payroll, stock up on extra inventory, launch a new marketing campaign, hire employees, buy materials or equipment for your next big project, renovate your office, or any other business need.

Unmatched support for your financial journey.

Your U.S. based funding advisor is here to help you through each step of the funding process.

(888) 993-3133

Monday – Friday | 7am – 5:30pm PT